Bear is back?

All the people that I read have been calling a top, at least for the short term. Most are pointing to the divergence between the large and small cap stocks. A great synopsis of the behavior is given by Asbury Research. Basically, the money moves to large, less risky stocks before a big slowdown in the economy.

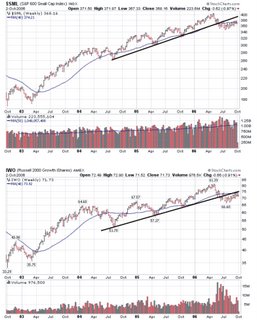

Here are some of my charts. First is the S&P 500. Everything looks great. It is back above the trend line and its 40 week average.

Not so pretty are the small caps. Here I show the Russell 2000 growth ETF and the S&P 600. Both of these guys are still below their trend lines and seem to be having trouble breaking through.

So what am I gonig to do about this? My plan is to be a little more cautious for the time being. I also will keep a close eye on my long positions and not be afraid to close them before if they break to the downside. I'm also going to keep my eye open for some good shorts. This market just sucks and I'm starting to think that I should just wait for another big downside move before I buy again.

On a political note, I'm getting pretty tired of people saying that the market is stalling because the democrats might win congress back. What a bunch of crap!

No comments:

Post a Comment