Short the SPY

In general, I feel most comfortable with technical analysis. As a "little guy" without any access to all of the information the big time stock operators have, I have little chance of being a successful value investor. I feel that my only hope is to watch how how the real stock operators move the market and jump on board as they push the markets up or down. What use is an undervalued stock if no one with the ability to move that stock cares to move it?

There are many different ways to watch charts. I have learned that any good chart analysis must begin with the relationship between price and volume, which is the method at the heart of Bill O'Niel's tech analysis. Basing buy points on chart patterns only, without volume consideration, is quite dangerous. (Like most beginners, I learned this the hard way.)

The CANSLIM method of Bill O'Niel is great, but it is for relatively long term investing and it requires one to buy stocks that are making new highs. I wanted a method to compliment this investment style with a more short term, bottom fishing technique. I have found exactly that with the Tom O'Brien radio show. He is an expert price and volume technician who's radio show can be found at TFNN.com. He also has a book that is a little on the basic side but still is useful. I originally learned about him through IBD and the monthly interviews he has with Bill O'Niel.

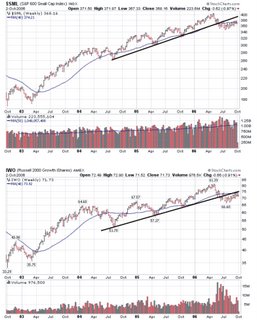

Tom O'Brien compliments his price and volume style with Fibonacci analysis, swing points, and candlesticks. He called the bottom of July and has been right on just about every call since (well at least for as long as I have been listening.) Right now he is calling for a medium sized pullback in the general market, with the S&P 500 falling to around 1320. I have some cash in reserve that I've been waiting to put to work and plan on doing so if his prediction proves correct again. Hell, I might even short the SPY or DIA for a quick trade. I must make my decision soon because when these corrections come, they come hard and fast.