Freeport-McMoRan (FCX) on the watchlist

Freeport-McMoRan is showing the signs of being a great short candidate. Here's the technical checklist.

- Head and shoulders with climax and island top!

- Increasing volume as head and shoulder progresses.

- Wedging.

- Decreasing relative strength.

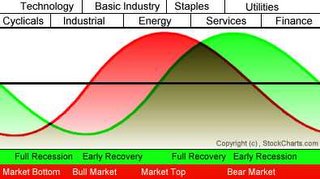

It's still too early to short, but keep your eyes on this one. Look for another drop and then rally back to the 50 dma. I think it is useful to remember the rules of sector rotation now that it looks like we are headed for a downturn in the economic cycle. Check out the sector rotation model.

I think it is useful to remember the rules of sector rotation now that it looks like we are headed for a downturn in the economic cycle. Check out the sector rotation model.

This cycle is why it is said to sell the cyclicals at their cheapest and buy at their most expensive. Most experts know this but sadly the common investor just looks at the P/E and growth of these stocks and assumes that there is no where else to go but up. Sadley, these folks are going to get killed when the smart money follows the playbook while they continue to mount losses. Just look at this post I found on the FCX yahoo message board. I hope he doesn't average down as he goes.

With forward PE down to signle digit with over 50% revenue/earning growth, FCX

is certainly the best among gold bugs. By wall street standard, FCX can have PE

between 50-100 with 50% growth. How the heck FCX not moving up is really beyond me.

No comments:

Post a Comment